Property market in 2025: recovery under scrutiny

The French property market will reach a turning point in 2025. After two years of falling prices and fewer transactions, the signs of recovery are multiplying. According to data from the national property price barometer published by SeLoger and Meilleurs Agents in January 2025, stabilising prices, falling interest rates and increased household purchasing power are giving buyers renewed confidence. But is this recovery sustainable?

Factors in the property market recovery

The end of 2024 saw signs of stabilisation in the market, a trend that looks set to continue in 2025. The main reason for this improvement is the easing of monetary policy by the European Central Bank (ECB), which has seen interest rates on mortgages fall from 4.35% to 3.5% in the space of a year. This has made it easier for households to buy their own home.

Price trends and transactions in major cities

Price trends in 2025 indicate that the market is stabilising. The major cities will record moderate variations, indicating a gradual end to the downward cycle that began in 2023.

Property prices on 1 January 2025 :

- Paris: €9,355/m² (-0.1%)

- Lyon: €4,362/m² (+0.4%)

- Bordeaux: €4,436/m² (+0.1%)

- Rennes: €3,774/m² (+0.3%)

- Toulouse: €3,462/m² (-0.5%)

- Nantes: €3,302/m² (-0.6%)

- Nice: €5,120/m² (+0.2%)

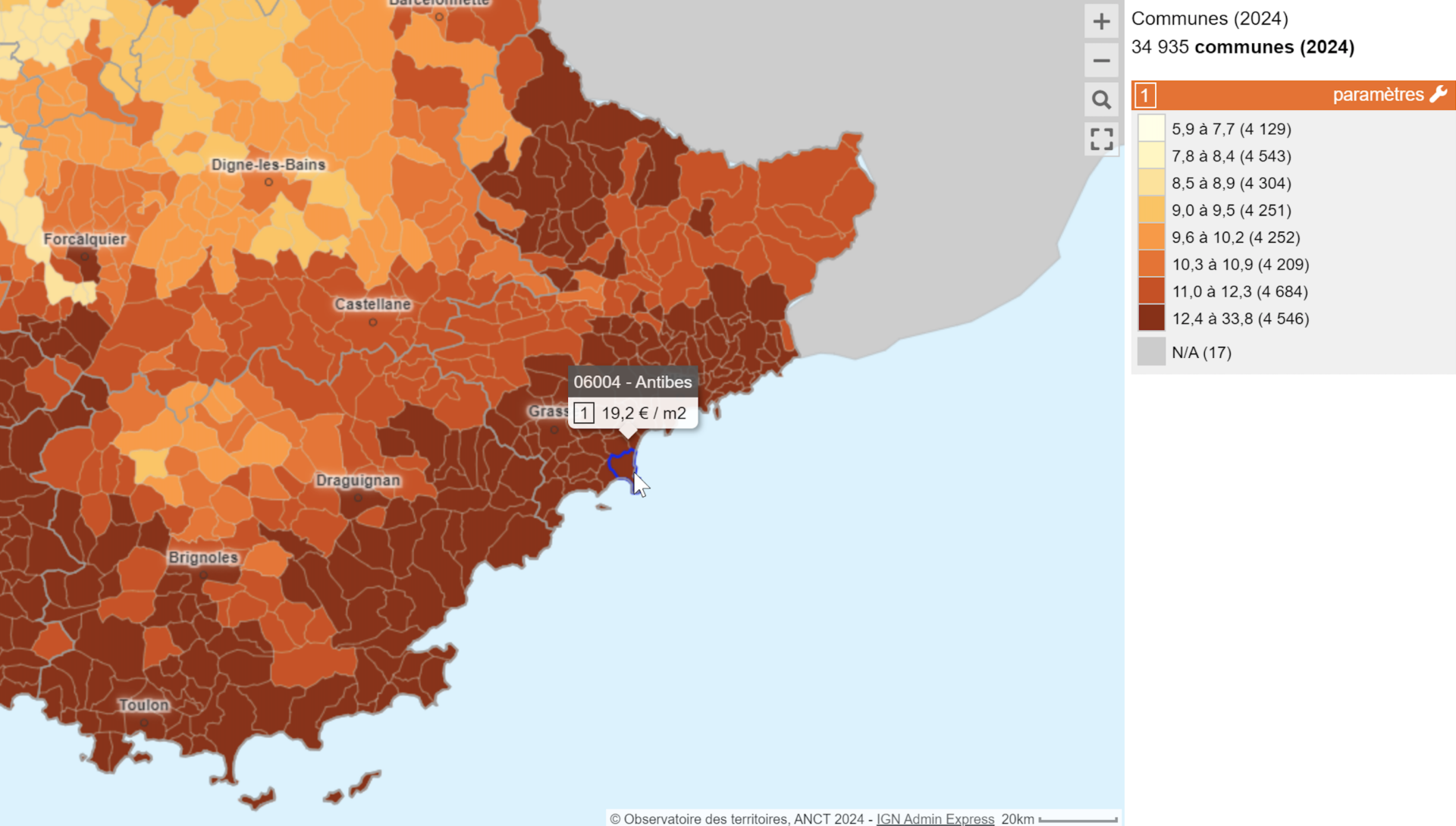

Regional disparities remain significant. While some major conurbations are seeing a slight rise in prices, others are experiencing stagnation or a fall. By contrast, rural areas are enjoying an average increase of +2.1%, confirming the growing interest in these areas.

The influence of interest rates on the property market

Lower interest rates are a key driver of the recovery. With the current rate at 3.5%, borrowing conditions have improved significantly compared with early 2024. Some forecasts even predict a rate of 3% before the summer of 2025, which would make the market even more dynamic.

Direct impact on buyers:

- +5 m² of additional floor space for the same budget.

- Increase in household debt capacity.

- Boosting demand in major conurbations.

Prospects and risks for real estate in 2025

Despite these encouraging signs, certain risks remain.

Economic and political factors

The French economy remains exposed to political and economic tensions that could affect market stability. A prolonged institutional crisis could dampen buyer enthusiasm and weigh on borrowing rates.

Availability of the offer

The supply of housing is tending to fall in some major cities. In Paris, it fell by -7% in 2024, while the Top 10 cities recorded a decline of -6%.

Potential consequences:

- Fewer properties available for buyers.

- Prices likely to rise in the second half of 2025.

Conclusion

The 2025 property market appears to be on a moderate recovery trend, driven by falling interest rates, stabilising prices and improved household purchasing power. However, economic and political uncertainties call for heightened vigilance. For investors and buyers, this could be an ideal window of opportunity.

➡ Advice: Are you looking for a property in Antibes? With Tanit Immobilier, you benefit from personalised support and a bespoke selection of properties, whether you’re looking for a flat with a sea view, a city flat, a luxury villa on Cap d’Antibes or any other property search. Our team is dedicated to finding the perfect property to meet your needs and expectations. Contact us today to make your real estate project a reality!